This is not an easy thing to do!

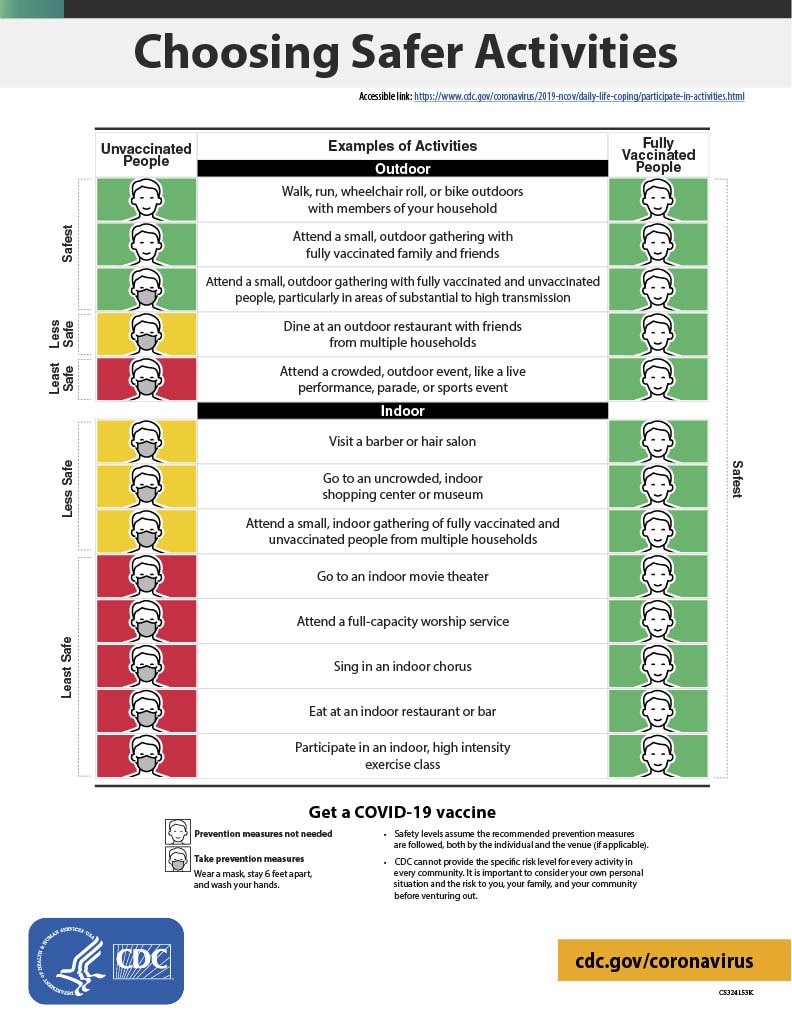

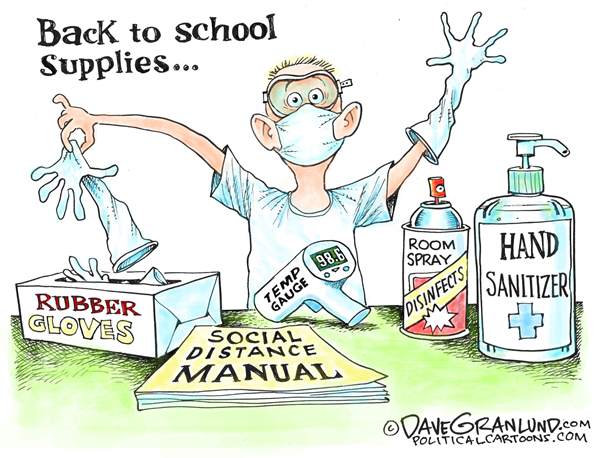

Mom died on Christmas eve 2020 in the midst of the COVID surge – not a direct COVID death – but sort of related. She didn’t want to seek medical care because of COVID and her medical condition worsened over the year.

Now we are attempting to get things cleaned out and settled.

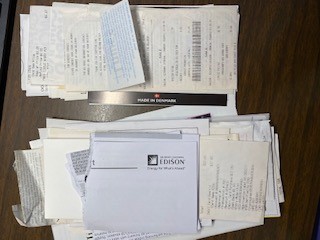

Why didn’t my parents have a will? WHO KNOWS! We have emptied every piece of paper from the house, garage, and storage shed and can’t find one. The finding of all the papers, sorting the papers, analyzing the papers, and shredding the papers has taken me about 10 solid days! When Dad passed, Mom didn’t have to worry about there being no will – surviving spouse and co-owner makes a huge difference in what you can do!

Now what do we need to do? The first thing that came to mind was “Hire an attorney”. This seems like something that should have been taken care of in January 2021. Was it? Nope! One brother thought he could arrange to sell the house with just her death certificate! So we finally have hired one (August 2021) and have a probate court date for the first week of October.

Old sibling issues are coming to the surface, specifically that I don’t know anything because I’m a girl – this was said to me so many times growing up by dad and brothers, it’s amazing that I can actually think at all. Thankfully, they aren’t saying that specifically but it sure comes across loud and clear when a suggestion is made, I’m told how I could possibly know that, they confer with their friends, and then suggest the same thing I said weeks earlier. Frustrating to say the least.

Is any of this estate settling stuff easy with 2 siblings? NO! It’s not easy when everyone agrees and there is a will (or better yet a trust). When you have siblings who can’t agree that the sky is blue, things become complicated quickly. It doesn’t help when one insisted he have power of attorney during mom’s last year, had neighbors sign that they witnessed mom sign (when they didn’t) and thinks that holds over after death. How do you quickly explain this? Not easily!

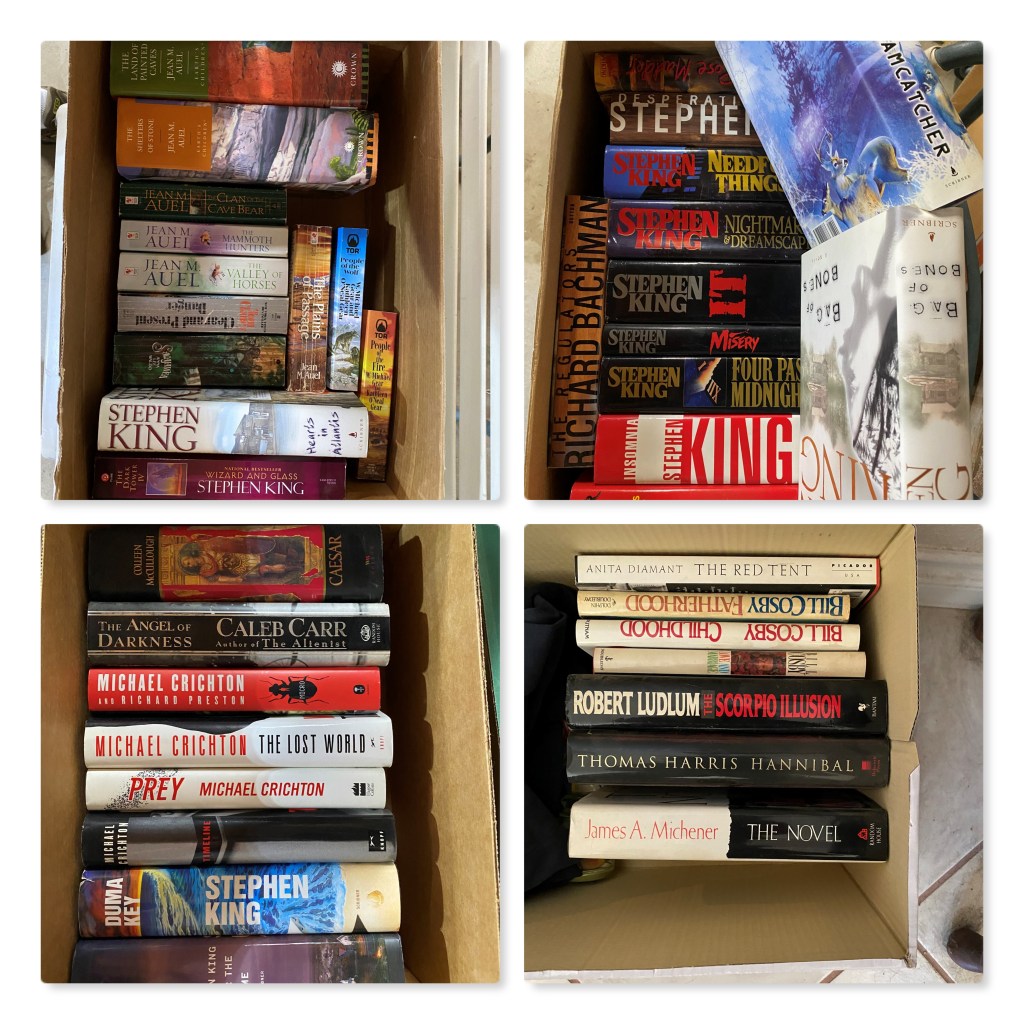

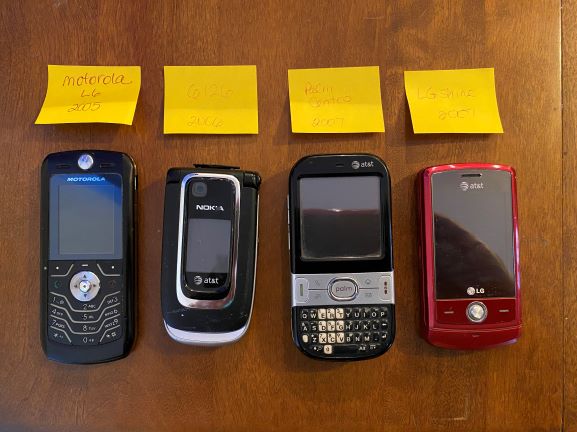

Was mom a hoarder? Thankfully no, but she saved all kinds of random stuff in boxes that were labeled incorrectly. As an example – box labelled books. It was heavy but not book heavy. Opened it up and it was full of my nephew’s school papers. (My parents had custody of my nephew – he was placed with them at about 6 months of age. He’s an adult now.)

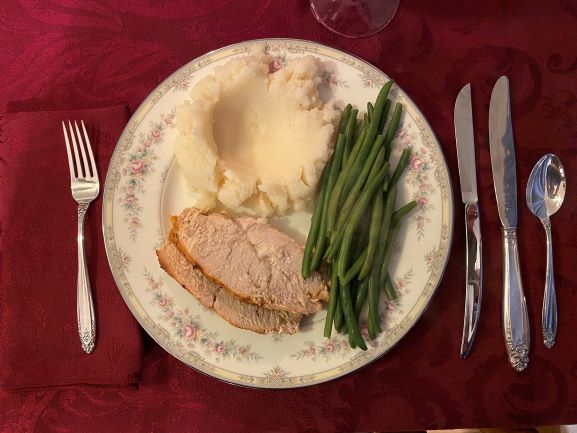

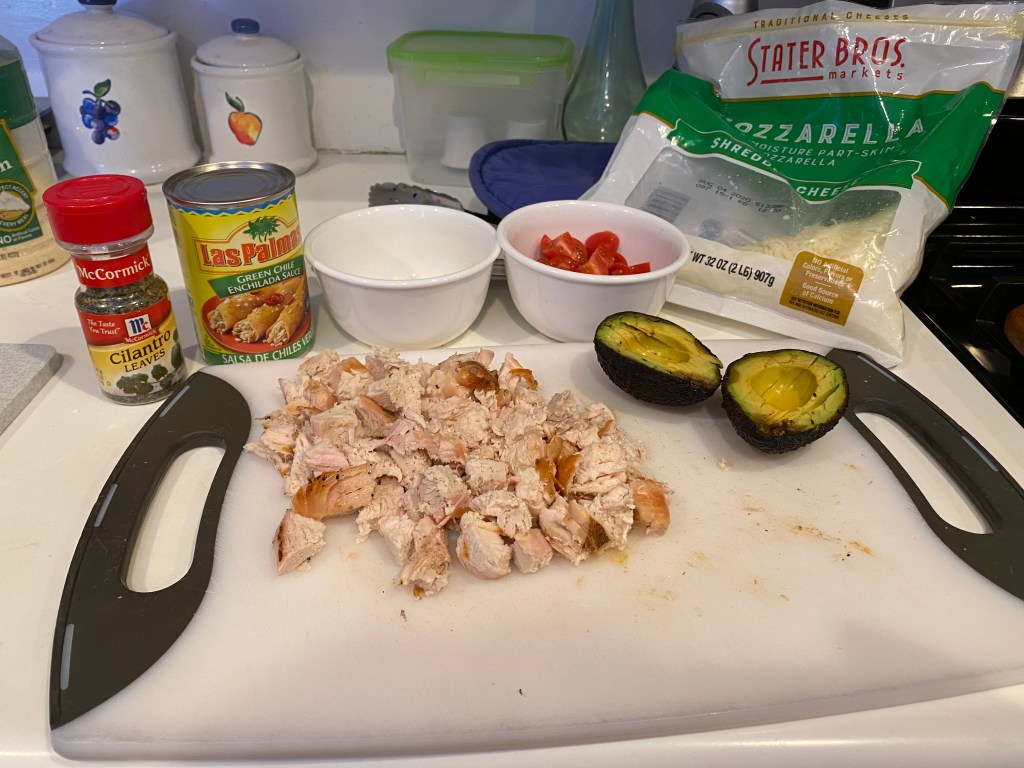

Now the big challenge is going through every other box, drawer, cupboard and figuring out if anything of value exists. We also meet recently to decide if there was anything we wanted. I asked for mom’s china – her brother/my uncle got it for her while in the army during Vietnam – and some of the old pictures. My brothers have already gone through the garage in the 2 years between their deaths and took stuff they wanted.

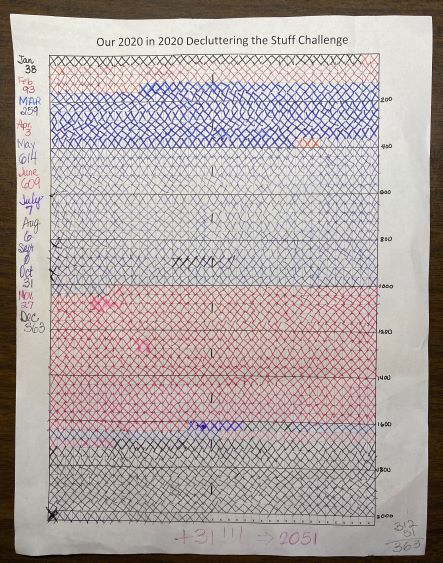

I think everything else can be trashed or donated. I’m accused of not caring about their belongings. sigh I just don’t want all of it at my house! One brother who has NO computer skills wants to place the stuff for sell online. When I asked who was going to do this, they both just sat there and looked at me like I was crazy. I just know I don’t have the energy to attempt to sell it. We’ve decluttered about 20,000 items from our house and didn’t sell a single thing – it was just too much to deal with. And I surely don’t want it all at my house!

So now I’m off to sort through some of my great-grandfather’s paperwork. As a genealogy fan, these have some value to me but are they worth keeping? Probably not! Photograph and move on will be my mantra.